KYT Special Report – Prince Group Transnational Criminal Organization Led by Chen Zhi

Background

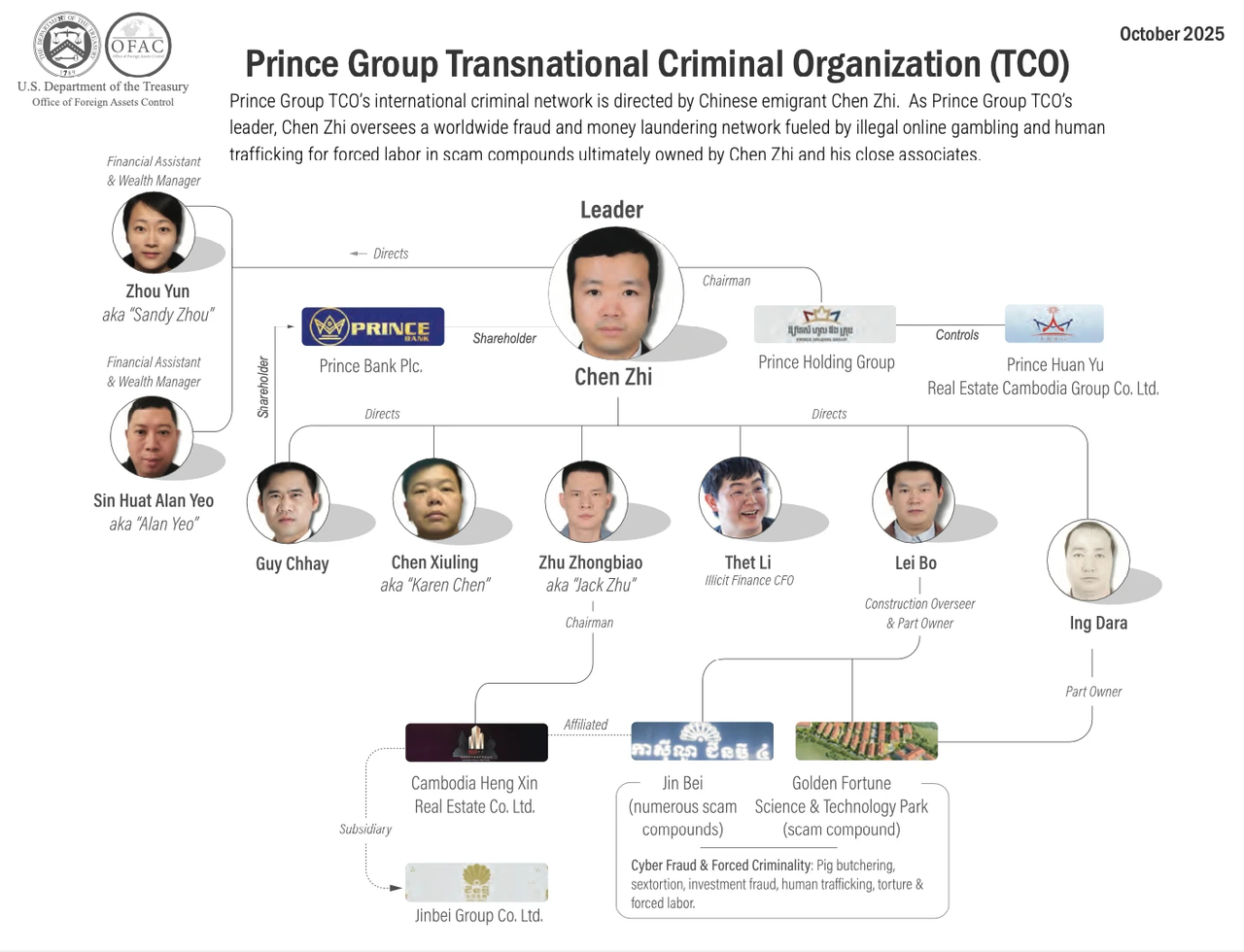

On October 14, 2025, the U.S. and U.K. governments jointly launched a transnational law enforcement operation, delivering a major blow to a large criminal syndicate based in Cambodia and its leader. The organization had long operated multiple notorious online fraud and cybercrime centers within Cambodia, involving massive illicit capital flows. The U.S. Office of Foreign Assets Control (OFAC) announced the designation of the Prince Group as a Transnational Criminal Organization (TCO), imposing financial sanctions on 146 associated individuals and shell entities.

Meanwhile, as part of a broader crackdown involving the Federal Bureau of Investigation (FBI), the U.S. Department of Justice (DOJ) announced the seizure of approximately 127,271 bitcoins—valued at around USD 15 billion at the time—marking the largest cryptocurrency seizure in U.S. history. This event signifies a new stage in global cooperation against crypto-based money laundering and transnational cybercrime.

I. Profile of Chen Zhi

Chen Zhi (English name: Vincent Chen Zhi) is a Chinese-Cambodian businessman, currently serving as Chairman of Prince Holding Group.

Chen’s personal trajectory represents a rapid and controversial rise to wealth, with the origins of his initial capital remaining a subject of speculation.

1.1 Personal Information and Early Experience

Date of Birth: December 16, 1987

Place of Birth: Xiao’ao Town, Lianjiang County, Fuzhou City, Fujian Province, China

Early Career: Formerly operated a small internet café business in Fuzhou, China

Citizenship: Cambodia, Vanuatu, Cyprus

Around 2011, Chen Zhi relocated to Cambodia and seized upon the local real estate boom, entering the Cambodian property development sector.

On February 16, 2014, he obtained Cambodian citizenship through investment-based naturalization.

1.2 Career Development and Honors

In 2015, Chen Zhi founded Prince Holding Group and rapidly expanded its operations into banking, finance, and tourism, making it one of the largest conglomerates in Cambodia.

Chen Zhi has acquired numerous honors and political appointments in Cambodia:

Political Advisor: Since 2017, Chen has served as an advisor to Cambodia’s Ministry of the Interior and to several senior officials, including Sar Kheng, Heng Samrin, Hun Sen, and Hun Manet.

(Chen Zhi pictured with then-Prime Minister Hun Sen on July 20, 2020, after being granted the title of 'Duke')

Duke Title: On July 20, 2020, he was conferred the Cambodian royal title of 'Duke'.

Business Awards: In 2021, Chen Zhi received the Stevie International Business Award for 'Entrepreneur of the Year' in the corporate group category.

Awards in Other Countries and Regions:

In 2021, Prince Group received the 'Corporate Social Responsibility Model Award' at the 10th China Finance Summit. (It was reported as 'the first and so far only Cambodian company ever to receive this award.')

In 2024, Prince Group was named by *World Economy Magazine* (U.S.) as the winner of the 'Best CSR Project in Cambodia' award. (Reports claim the Group has conducted over 250 philanthropic projects, donating more than USD 16 million.)

II. Corporate Structure and Illicit Operations of Prince Group

Although Prince Group presents itself as a diversified business conglomerate, investigations by U.S. and U.K. authorities have revealed its true identity as a 'Transnational Criminal Organization' (TCO), with core operations centered on cybercrime conducted through scam compounds.

(As of October 30, 2025, the Prince Group official website – https://www.princeholdinggroup.com – remains active)

2.1 Public Operations and Charitable Image

Headquartered on Diamond Island, Phnom Penh, Prince Group claims its core businesses encompass real estate development, financial services, and consumer services. Its major subsidiaries include Prince Real Estate Group, Prince Huan Yu Real Estate Group, and Prince Bank (a licensed commercial bank), in addition to aviation and investment divisions.

The Group has undertaken numerous large-scale projects across Cambodia: major residential and commercial complexes in Sihanoukville, and office and retail landmarks in Phnom Penh, such as Prince Happiness Plaza and Prince Central Plaza. According to the company’s official website and media reports, the Group controls more than 80 subsidiaries and affiliated companies within Cambodia.

Prince Group claims to have expanded its operations to over 30 countries and regions. Public data show that over 100 companies linked to Chen Zhi or Prince Group have been listed under U.S. and international sanctions.

Prince Group has been involved in virtual currency investment scams in multiple countries, including the United States.

Proceeds from these scams were laundered through a network of offshore shell and holding companies primarily located in:

British Virgin Islands (BVI)

Cayman Islands

Singapore

Hong Kong

Taiwan

Global Footprint of Prince Group

(Source: U.S. Office of Foreign Assets Control – OFAC)

The map identifies the following regions and their respective roles:

| Region/Country | Role Description |

|---|---|

| Cambodia | Primary operational headquarters of the Prince Group TCO |

| Hong Kong | Offshore financial hub used for money laundering and fund transfers |

| Singapore | One of the key centers for investment and fund transit |

| British Virgin Islands (BVI) and Cayman Islands | Used to conceal fund flows through shell and holding companies |

| Taiwan | Used as a front for fund masking or investment vehicles |

| Palau | Partnered with organized crime intermediaries for predatory investments |

| United States | Location of fraud victims; funds from victims were funneled into the Prince Group’s illicit network |

These illicit funds were ultimately commingled with the Group’s ostensibly legitimate business activities. Additionally, the Group collaborated with known organized crime facilitators to conduct predatory investments in Palau.

Through its Prince Foundation, the Group actively engages in charitable activities, publicly claiming to have donated over USD 16 million, in an effort to project a positive social image.

2.2 Illicit Operations: Transnational Criminal Organization

On October 14, 2025, the U.S. Office of Foreign Assets Control (OFAC) designated Prince Group as a 'Transnational Criminal Organization' (Prince Group TCO), stating that the entity, led by Chen Zhi, operates a global fraud and money laundering network driven by illegal online gambling and human trafficking.

2.2.1 Core Operational Model

1. Large-Scale 'Pig-Butchering' Scams

The core illicit business of Prince Group consists of extensive cryptocurrency 'pig-butchering' scams.

Chen Zhi is accused of orchestrating a transnational 'pig-butchering' crypto scam empire, operated through forced-labor scam compounds in Cambodia.

Methodology: Under the guise of legitimate real estate, finance, online gambling, and crypto mining operations, the Group established at least ten scam compounds within Cambodia.

Scale and Profits: The criminal network reportedly generates illicit profits amounting to tens of millions of dollars per day.

Additional Crimes: The organization has also been accused of profiting from a range of transnational offenses, including sexual extortion (coercing victims into producing explicit materials for later blackmail).

2. Money Laundering Mechanisms

Prince Group has long obscured its operations through a complex transnational corporate structure, employing sophisticated laundering and fund transfer techniques. The Group integrates illicit proceeds into the legitimate economy via casinos, hotels, and cryptocurrency exchanges. Official reports also indicate that Prince Group operated fraudulent online investment platforms, channeling illicit proceeds back into real estate or overseas financial markets, thereby expanding its global influence. Overall, while publicly engaged in legitimate industries, the Group in reality conducts extensive cross-border criminal activities through scam compounds and offshore financial networks.

2.2.2 Human Trafficking and Forced Labor

Prince Group’s operations involve severe human trafficking and forced labor, amounting to grave violations of human rights.

Forced Labor: Individuals in the compounds were forcibly confined in prison-like facilities and coerced to participate in cryptocurrency investment fraud schemes.

Violence and Torture: Acts of physical violence and torture were reported within the scam compounds.

2.3 Transnational Reach and Political Protection

Prince Group’s criminal operations are highly transnational in nature, with activities and assets distributed globally and protected by political influence.

Main Bases: Cambodia (hosting at least ten scam compounds) and numerous subsidiaries in multiple countries.

Political Protection: Indictments explicitly allege that Chen Zhi and his associates 'leveraged their political influence across multiple countries, including Cambodia, bribing public officials to shield their fraud operations from law enforcement scrutiny.'

Global Assets: Chen Zhi and his associates laundered criminal proceeds through complex financial channels to fund luxury travel and asset acquisitions.

III. Official Disclosures and Sanctions by the U.S., U.K., and Other Governments

On October 14, 2025, the U.S. and U.K. governments launched the largest-ever joint operation targeting a Southeast Asian cybercrime syndicate, filing criminal charges, imposing comprehensive sanctions, and seizing assets belonging to Chen Zhi and Prince Group.

3.1 Comprehensive Sanctions by the U.S. Office of Foreign Assets Control (OFAC)

The U.S. Office of Foreign Assets Control (OFAC) imposed comprehensive sanctions against the Prince Group Transnational Criminal Organization (Prince Group TCO).

Scope of Sanctions: A total of 146 individuals and entities within the Prince Group TCO network were subjected to full sanctions.

Legal Basis: The sanctions were enacted under Executive Order 13581 and its amendments, targeting transnational criminal organizations.

Sanctioned Parties: The sanctioned entities include affiliates of Prince Group and three Singaporean nationals associated with the organization.

3.2 Joint Asset Seizure: The Largest in History

Law enforcement agencies from the United States and the United Kingdom — namely the U.S. Department of Justice (DOJ) and the U.K. National Crime Agency (NCA) — jointly executed a historic asset seizure operation:

“The DOJ and NCA jointly seized approximately 127,271 bitcoins, valued between USD 14 billion and 15 billion — marking the largest cryptocurrency seizure in U.S. history.”

These massive funds are believed to represent illicit proceeds accumulated through Prince Group’s transnational criminal activities.

3.3 Sanctions and Asset Freezes by the U.K. Government

The U.K. government, under the Global Human Rights Sanctions Regulations, imposed sanctions on Chen Zhi for his involvement in severe human rights abuses related to forced labor.

Consequences of Sanctions: All of Chen Zhi’s assets in the U.K. — including 19 properties in London valued at over GBP 100 million — were frozen.

Financial Exclusion: Chen Zhi and his network were immediately barred from access to the U.K. financial system.

3.4 International Chain Reactions

Following the U.S.-U.K. joint operation, the international community responded swiftly:

Investigations by Other Countries:

Authorities in Taiwan, South Korea, and Hong Kong have frozen Prince Group’s local assets and corporate holdings.

Thailand and Singapore have also launched independent investigations into the Group.

According to Taiwanese media, Prince Group established nine companies in Taiwan — one located in Taipei 101 Tower, and the remaining eight based in Da’an District’s luxury residence 'Peace Palace' (where the famous singer Jay Chou also resides).

(Luxury residential complex 'Peace Palace' in Taipei’s Da’an District)

IV. How to Conduct Transactional Risk Control and Avoid Financial Exposure

Given the complexity of transnational fraud and money-laundering networks, manual methods alone are insufficient to reconstruct fund flows or identify accountable entities. Trustformer KYT provides a closed-loop risk screening framework, enabling users to rapidly detect and block the movement of illicit capital ('black money').

1. Data Collection and Enrichment

The system collects transaction and address data in real time from mainnet full nodes, exchange public data, sanctions lists, and open-source intelligence (OSINT), linking addresses, exchanges, wallets, and media reports through knowledge graphs to establish a complete event context.

2. Intelligent Risk Screening (Primary Filtering)

Each transaction undergoes multidimensional risk analysis, including amount thresholds, frequency, known mixers, and hits on historical blacklists or sanctions lists, producing an initial risk score for the transaction or address.

3. Entity Clustering and Labeling

By applying address clustering and entity recognition algorithms, the system consolidates multiple addresses controlled by the same entity (Address Bundling) and labels them within the knowledge graph — for instance, 'real estate company / exchange account / offshore entity' — to strengthen evidentiary support.

For example:

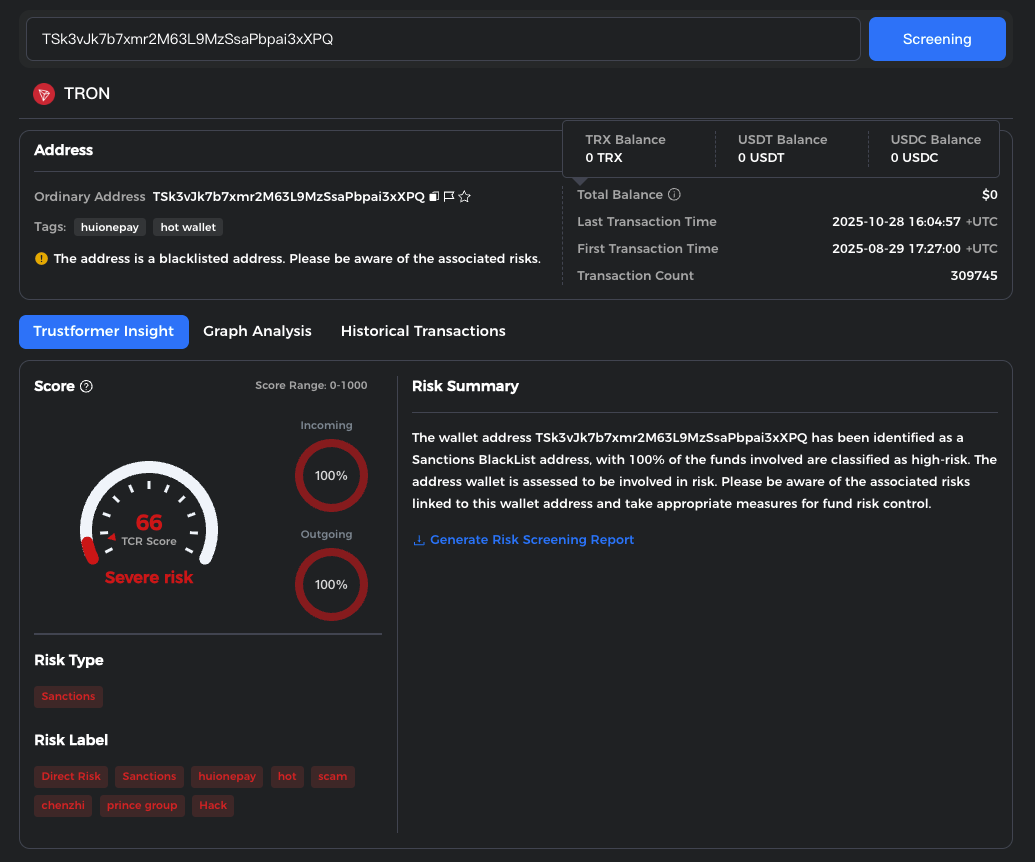

1. huionepay address: TSk3vJk7b7xmr2M63L9MzSsaPbpai3xXPQ

Using the Trustformer KYT system for risk screening, this address was detected as 'Severe Risk.' Risk Type: Sanctions. Risk Tags include: Direct Risk, huionepay, chenzhi, prince group, scam, hack, hot. The address has been listed on the sanctions blacklist, with 100% of its funds identified as high-risk.

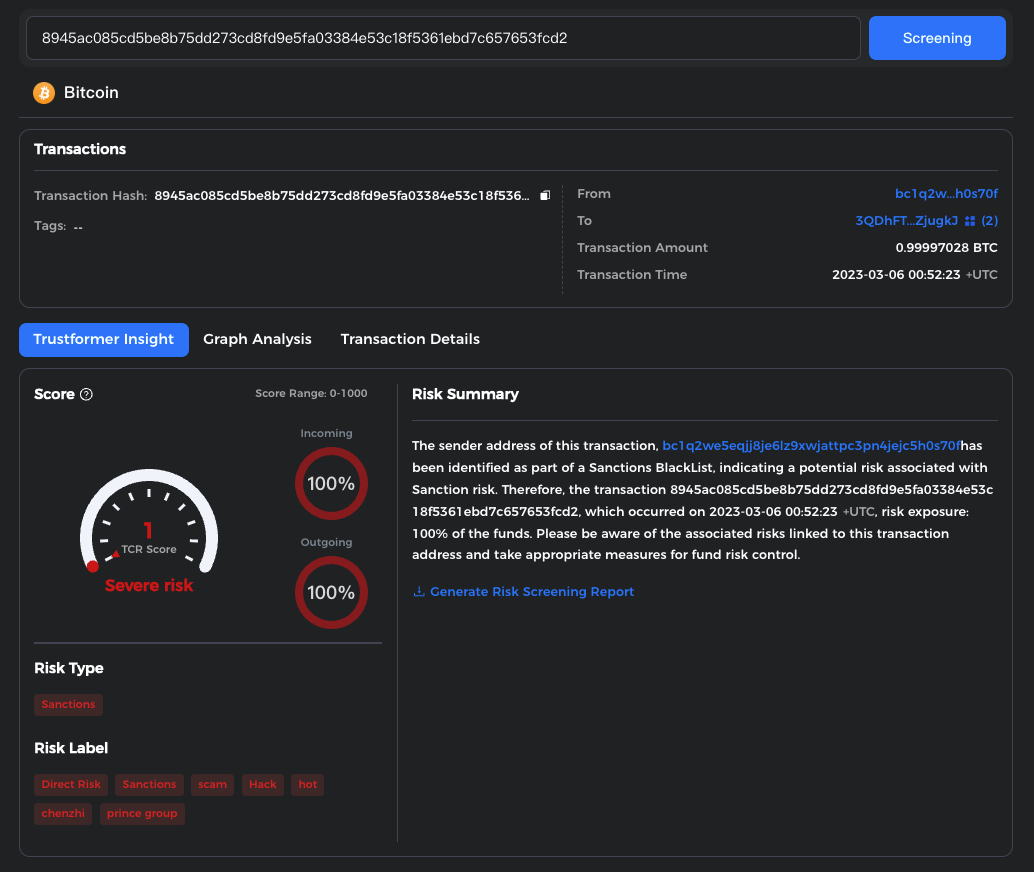

2. LuBian transaction: 8945ac085cd5be8b75dd273cd8fd9e5fa03384e53c18f5361ebd7c657653fcd2

Using the Trustformer KYT system for risk screening, this transaction was identified as 'Severe Risk.' Risk Type: Sanctions. Risk Tags include: Direct Risk, chenzhi, prince group, scam, hack, hot. The sender address (bc1q2we5eqjj8je6lz9xwjattpc3pn4jejc5h0s70f) was found on the sanctions blacklist, with 100% of funds assessed as high-risk due to sanction exposure.

With Trustformer KYT, institutions can promptly identify high-risk fund flows and build a robust transaction risk control framework, preventing potential threats at the source.

V. Conclusion

The joint crackdown by the U.S. and U.K. governments against the Prince Group marks a new milestone in global Anti-Money Laundering (AML), Counter-Terrorist Financing (CFT), and transnational cybercrime governance. Through targeted identification, asset freezes, and the record-setting Bitcoin seizure, authorities have, for the first time, exposed the full black economy chain linking Southeast Asian scam compounds, cryptocurrencies, and offshore financial systems.

This case not only highlights how criminal organizations exploit the legal façades of real estate, finance, and digital assets for systemic money laundering, but also reveals how weak regulation and political protection in certain countries have created fertile ground for organized crime. Moving forward, cross-border compliance for crypto assets, on-chain tracking, and integrated risk governance between crypto and traditional finance will remain key enforcement and regulatory priorities worldwide.

For crypto-financial practitioners, this incident serves as a stark reminder: establishing rigorous KYT (Know Your Transaction) and KYC (Know Your Customer) frameworks, identifying suspicious fund flows, and monitoring high-risk or sanctioned wallets are essential to mitigate compliance and reputational risks. By leveraging the Trustformer KYT system, institutions can achieve unified management across fund risk control, compliance auditing, and on-chain risk defense. Powered by AI algorithms and knowledge graph models, the system performs real-time risk identification, scoring, and alerting — helping users prevent potential financial threats, enhance AML/CFT compliance, and build a more resilient crypto-financial defense system.